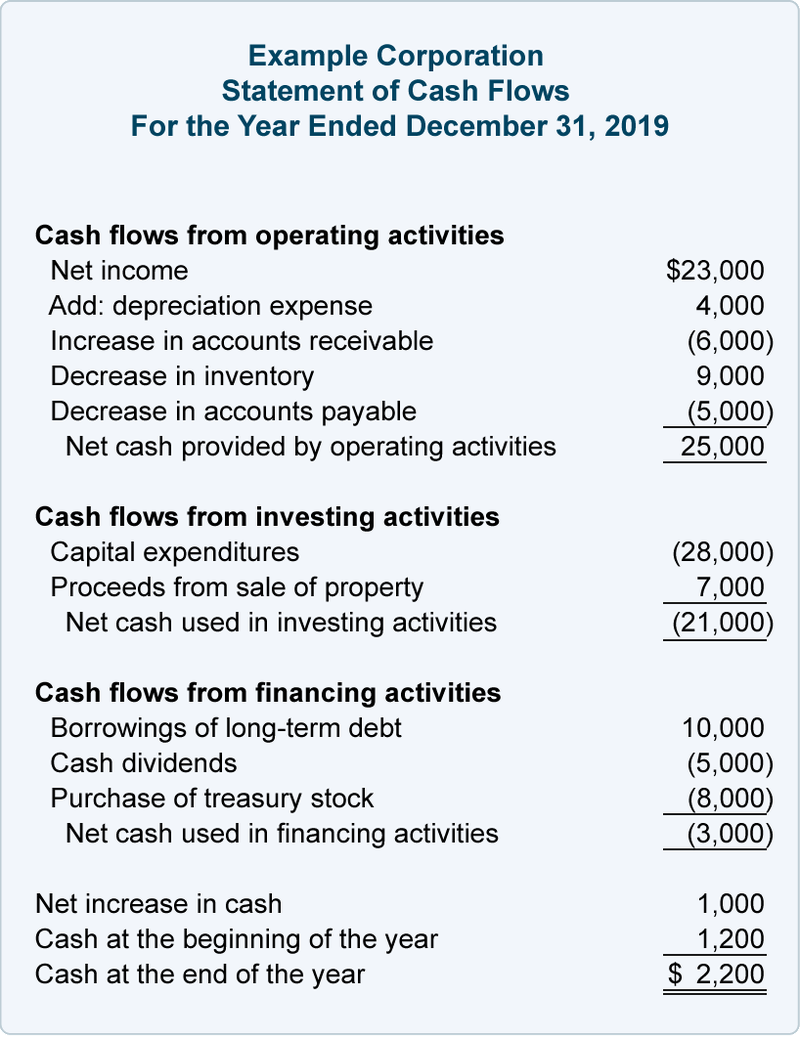

This report shows the net flow of funds used to run the company including debt, equity, and dividends. Also known as the profit and loss statement, the income statement focuses on business income and expenses. Cash flow from financing activities (CFF) measures the movement of cash between a firm and its owners, investors, and creditors. The balance sheet shows the assets and liabilities as well as shareholder equity at a particular date. The other two important statements are the balance sheet and income statement. The cash flow statement is one of the three main financial statements that show the state of a company's financial health. Debt and equity financing are reflected in the cash flow from financing section, which varies with the different capital structures, dividend policies, or debt terms that companies may have.Financing activities include transactions involving debt, equity, and dividends.Cash flow from financing activities is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company.Shareholders might believe that if a company makes a profit after tax of say 100,000, then this is the. Readers of a companys financial statements might even be misled by a reported profit figure. All activities as above are considered as investing activities and recorded in Investing Activities Cash flow. It can be argued that profit does not always give a useful or meaningful picture of a companys operations. Moreover, Intel’s owners could think of selling their PPE in an area so as to gain money and invest in a new factory. Companies in the manufacturing industry like Intel spent lots of money on building and maintaining factories as well as supporting suppliers. Let us take an example in the manufacturing industries. Finance activities include the issuance and repayment of equity, payment of dividends, issuance and repayment of debt, and capital lease obligations. Therefore, it is not necessary to look at the net cash flow from investing activities and be upset at the business. Cash Flow from Financing Activities is the net amount of funding a company generates in a given time period. It would not be a sustainable way to continue financing the company. If Company ABC had a negative net cash flow, however, this could indicate that borrowing was supporting operations. This means that the company earned enough cash from operations to support investing and financing activities. Then, the company spends its money on buying new fixed assets or re-invest into other entities. Company ABC has a positive net cash flow of 970,000.

The statement also informs about cash outflows. Another way to get money is to sell its PPE – property, plant, and equipment. Incoming cash for a business comes from operating activities, investing activities and financial activities. In contrast, cash flow from investing activities are those that arise due to the business transactions in cash for your businesss long-term investments in long. In order to maintain and expand the business, the company receives money from outside investors or its owner. The cash flow statement in the financial statements helps you see whether the company is growing. Cash flow stems from operations, investing and financing activities, and normally moves from negative to positive as you grow past the startup phase. Money from new investment, both from the company or from an investor to the company, and sales of fixed assets are comprised in the investing activities cash flow. Cash flow is critical to a business so you must manage your cash flow wisely.

Investing activities cash flow contains the changes during a reporting period on investment losses or gains.

0 kommentar(er)

0 kommentar(er)